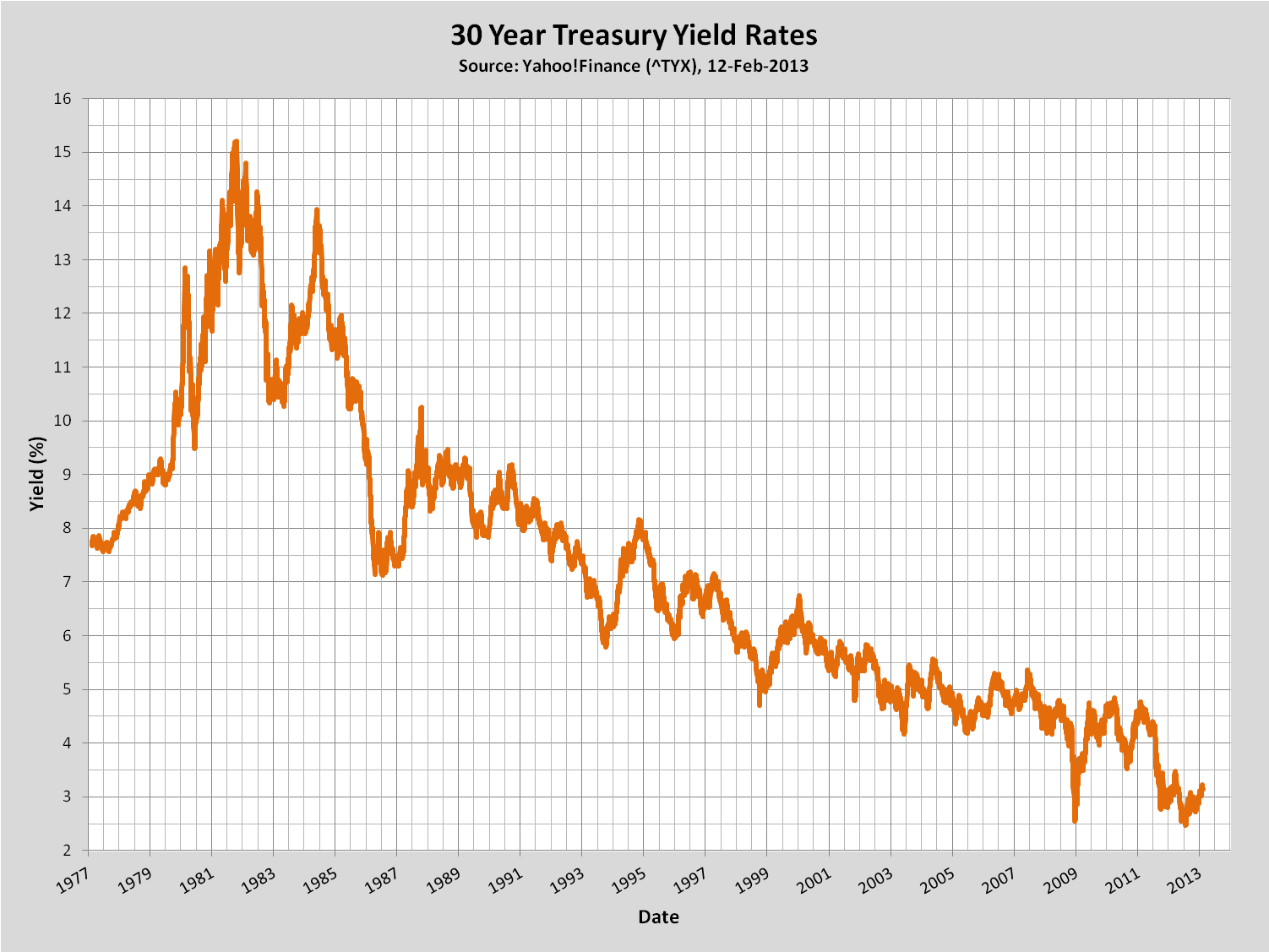

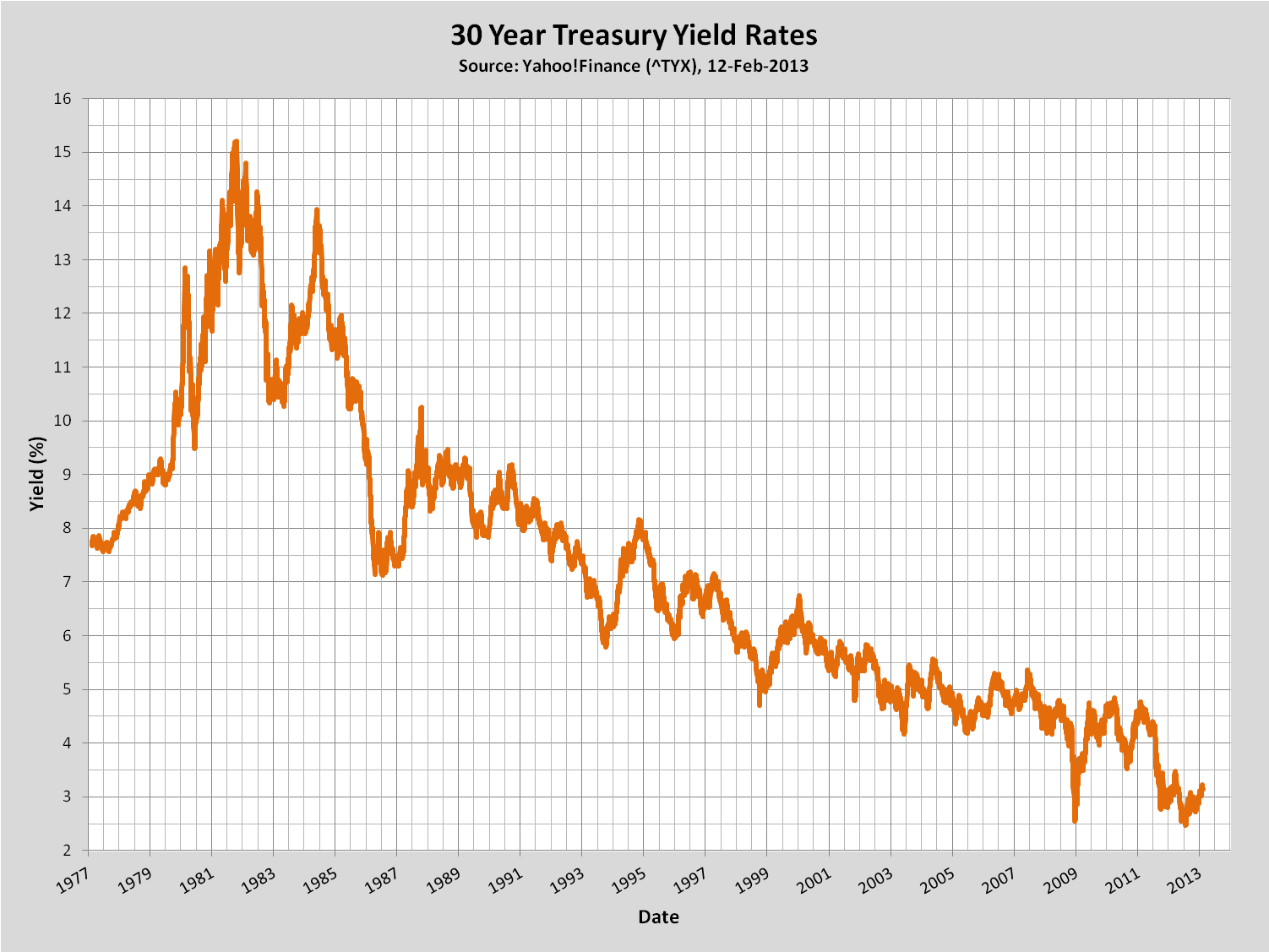

See below for a plots of historical data of inflation rates and long-term yields (click on a figure to see a larger version).

|

Max. Discount Rate Term Yearly Interest Rate Points Closing Costs |

|

|

|

|||

|

|

||||||

|

Yearly Interest Rate Points Closing Costs |

|

|||||